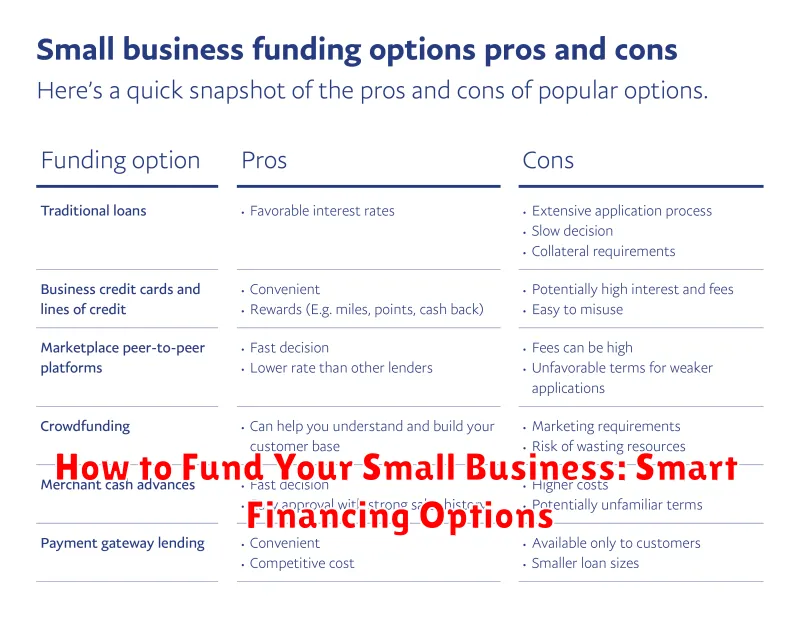

Securing adequate funding is crucial for the success of any small business. Whether you’re just starting up or looking to expand, understanding your financing options is essential. This article explores various smart financing options available to small businesses, providing you with the knowledge to make informed decisions and secure the capital you need to thrive. We’ll delve into the pros and cons of each option, helping you identify the most suitable funding solution for your specific business needs. From traditional business loans to innovative crowdfunding platforms, you’ll gain a comprehensive understanding of how to fund your small business effectively.

Navigating the complex world of small business financing can be challenging. This guide aims to simplify the process, outlining key considerations for choosing the right funding source. We’ll cover topics such as determining how much funding you require, preparing a compelling business plan, and understanding the requirements for each financing option. Whether you need funding for inventory, equipment, marketing, or expansion, this article provides valuable insights into the best strategies for funding your small business and achieving your entrepreneurial goals. By exploring these smart financing options, you can confidently secure the resources necessary to launch, grow, and sustain your small business.

Understanding Startup Capital Needs

Before seeking funding, it’s crucial to determine your startup capital needs. This involves calculating all initial expenses required to launch and operate your business until it becomes self-sustaining.

These costs typically fall into two categories: one-time startup costs (e.g., equipment, licenses, initial marketing) and ongoing operating expenses (e.g., rent, salaries, inventory). Accurately estimating these figures is essential for securing appropriate financing.

Creating a detailed financial projection can help you determine your capital needs. Consider developing both best-case and worst-case scenarios to understand the potential range of your financial requirements.

Bootstrapping: Pros and Cons

Bootstrapping involves funding your business using your own resources. This can include personal savings, revenue generated from early sales, or even credit cards. It’s a common approach for startups, especially when securing external funding is challenging.

Pros

A major advantage is retaining complete control over your business. You don’t have to answer to investors or share profits. Bootstrapping also encourages financial discipline and forces you to prioritize spending. Furthermore, it can make your business more attractive to future investors, demonstrating your commitment and resourcefulness.

Cons

Bootstrapping can limit your growth potential, especially if your business requires significant upfront investment. It can also be incredibly stressful, putting pressure on your personal finances. Finally, it might take longer to achieve your business goals compared to businesses with external funding.

Business Loans and Credit Lines

Business loans provide a lump sum of capital upfront, repaid with interest over a fixed term. They’re suitable for specific, large investments like equipment purchases or real estate.

Credit lines, conversely, offer flexible access to funds up to a predetermined limit. You borrow and repay as needed, making them ideal for managing ongoing expenses and fluctuating cash flow.

Key differences lie in their structure. Loans are disbursed once, while credit lines are revolving. Interest is charged only on the used portion of a credit line.

Angel Investors and Venture Capital

Angel investors are individuals who invest their own capital in early-stage companies. They often provide mentorship and guidance in addition to funding. Venture capital (VC) firms, on the other hand, invest pooled money from various sources into more established businesses with high growth potential.

Both options typically seek equity in your company. VC funding often comes in larger amounts than angel investments. Securing either requires a compelling business plan, a strong management team, and a clear path to profitability.

Key differences include investment size, stage of business, and level of involvement. Angel investors typically invest smaller amounts in earlier-stage ventures, while VC firms invest larger sums in later-stage companies. Angels are often more hands-on, providing mentorship and network access, while VC firms primarily focus on financial returns.

Grants for Small Businesses

Grants are essentially free money for your business. Unlike loans, grants do not need to be repaid. This makes them a highly desirable funding option. However, grants are often competitive and come with specific requirements.

Key Considerations:

- Eligibility: Grant eligibility varies widely depending on the grant provider and the intended use of the funds. Factors like industry, location, business size, and business owner demographics can all play a role.

- Application Process: The application process can be rigorous, requiring detailed business plans, financial projections, and other documentation.

- Reporting Requirements: Grant recipients often have reporting requirements to demonstrate how the funds were utilized.

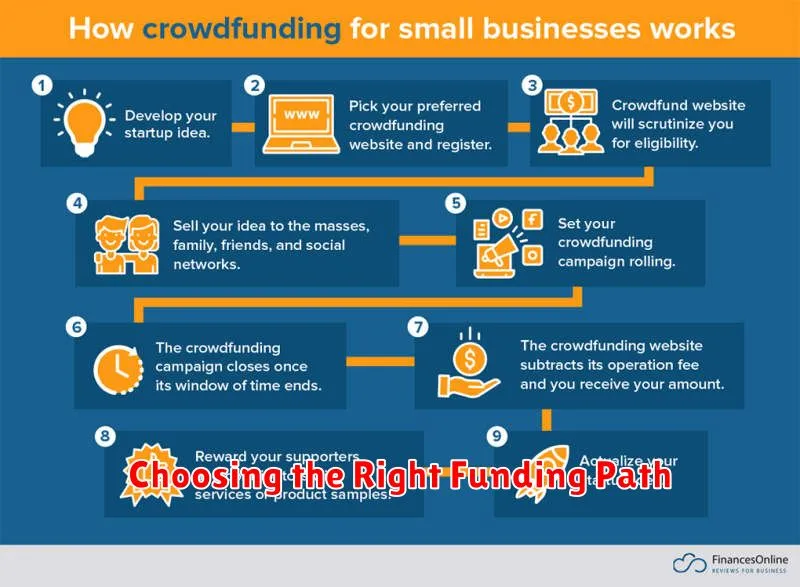

Crowdfunding Your Product or Idea

Crowdfunding presents a unique avenue for securing capital, particularly for new products or innovative ideas. It involves raising small amounts of money from a large number of people, typically via online platforms.

Key advantages include early validation of your product’s market appeal, building a community around your brand, and generating pre-orders before production begins.

However, crowdfunding is not without its challenges. A successful campaign requires significant effort in marketing and communication to reach a broad audience. There are also platform fees and the possibility of not reaching your funding goal.

Consider crowdfunding if you have a compelling product story and the resources to manage a robust campaign. It’s an excellent option for businesses with a strong online presence and a dedicated following.

Revenue-Based Financing

Revenue-based financing is a funding option where a business receives a lump sum of capital in exchange for a percentage of its future revenues. It’s a debt-like instrument but unlike a traditional loan, there are no fixed monthly payments. Instead, repayments are tied to the business’s revenue performance.

This makes revenue-based financing particularly attractive to businesses with fluctuating revenues. Investors receive a predetermined percentage of revenue until the principal and agreed-upon return are repaid. This provides flexibility as repayments are higher when revenue is strong, and lower when revenue is down.

Friends, Family, and Personal Loans

Tapping into your personal network can be a viable option for initial funding. Borrowing from friends and family offers the advantage of flexible repayment terms and potentially lower interest rates. However, it’s crucial to formalize these agreements with a written contract to protect both parties and avoid misunderstandings.

Personal loans are another readily accessible source of funding, particularly for smaller amounts. These loans typically come with fixed interest rates and predetermined repayment schedules. Be sure to carefully compare interest rates, fees, and loan terms from different lenders to secure the most favorable option for your business needs.

Government and Local Support Programs

Beyond traditional financing, explore government-backed programs designed to support small businesses. These programs often offer favorable terms, including lower interest rates and more flexible repayment schedules.

Small Business Administration (SBA) loans are a prime example. The SBA partners with lenders to reduce risk for financial institutions, making it easier for small businesses to qualify for loans. Grants are also available for specific industries or demographics, offering non-repayable funding for eligible businesses.

Explore local initiatives as well. Many cities and states offer tax incentives, business development programs, and mentorship opportunities. Check with your local chamber of commerce or economic development agency for region-specific resources. These programs can significantly reduce the financial burden on startups and growing businesses.

Choosing the Right Funding Path

Selecting the right funding option is crucial for your small business’s success. Carefully consider your business needs, financial situation, and risk tolerance.

Key factors to evaluate include the amount of funding required, the repayment terms, and the potential impact on your business’s ownership and control. Consider whether you need short-term financing for immediate needs or long-term capital for expansion.

Explore various options, such as bootstrapping, small business loans, lines of credit, or equity financing. Each option has its advantages and disadvantages. Due diligence is essential to make an informed decision that aligns with your long-term goals.