Registering your business is a crucial step in establishing its legal presence and ensuring its smooth operation. Whether you’re launching a small startup, expanding an existing venture, or formalizing a freelance career, understanding the registration process is essential. This comprehensive guide provides a step-by-step approach to registering your business, covering everything from choosing the right business structure to fulfilling the necessary legal requirements. Successfully navigating these procedures can offer significant benefits, including enhanced credibility, access to funding, and legal protection. By following this guide, you can ensure your business registration is handled efficiently and effectively, setting a solid foundation for future growth and success. Learn how to register your business, and understand the importance of business registration.

This step-by-step guide simplifies the often complex process of business registration, breaking down the key steps into manageable tasks. From selecting the appropriate business name and structure (sole proprietorship, partnership, LLC, etc.) to obtaining the necessary licenses and permits, this guide will empower you to confidently register your business. We will explore the different registration requirements for various business types and provide practical advice to streamline the process. By understanding how to register a business correctly, you can mitigate risks, ensure compliance, and focus on what matters most – growing your business. Let us delve into the essential steps for successfully registering your business and lay the groundwork for a thriving enterprise.

Choosing the Right Business Structure

Selecting the right business structure is a critical first step in registering your business. The structure you choose impacts your legal liability, tax obligations, and administrative burden.

Common business structures include:

- Sole Proprietorship: Simple to set up, but offers no legal distinction between the business and the owner.

- Partnership: Similar to a sole proprietorship, but with two or more owners.

- Limited Liability Company (LLC): Offers some liability protection and flexible tax options.

- Corporation (S Corp or C Corp): Provides the strongest liability protection, but involves more complex regulations.

Consider your business’s size, industry, and long-term goals when making your decision. Consulting with a legal or financial professional can provide valuable guidance.

Naming Your Business Legally

Choosing a name for your business is a crucial step in the registration process. The name you choose must comply with legal requirements. A legally compliant name is essential for avoiding future issues.

Firstly, your business name must be distinguishable from other registered businesses in your state. This means it can’t be too similar to an existing business name. Secondly, certain words, such as “bank” or “insurance,” may require additional approvals or licenses to use.

Check your state’s specific naming guidelines for details on restricted words and required designations like “LLC” or “Inc.” Performing a thorough name search on your state’s business registry website is highly recommended to ensure availability and avoid legal conflicts.

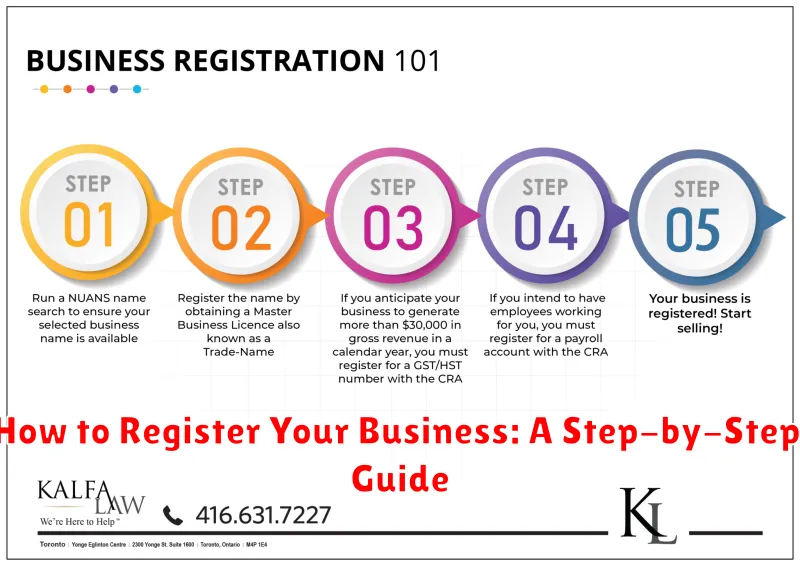

Registering at State and Federal Level

After you’ve chosen a business structure and name, you’ll need to register your business at both the state and federal levels. State registration requirements vary, so it’s essential to check with your specific state’s website or relevant agency for detailed instructions. Typically, this involves filing formation documents and paying a fee.

Federal registration primarily applies to businesses structured as corporations, partnerships, or LLCs that have more than one owner. This usually involves obtaining an Employer Identification Number (EIN) from the IRS. Sole proprietorships with no employees generally don’t require an EIN, but obtaining one can be beneficial for tax and banking purposes.

Getting Your Tax ID (EIN)

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique nine-digit number assigned by the IRS. It’s used to identify your business for tax purposes. Most businesses will need an EIN.

You can apply for an EIN online through the IRS website. The application is relatively straightforward and you will receive your EIN immediately upon completion. Ensure you have all necessary information about your business structure and responsible party readily available.

Key reasons why you might need an EIN:

- Hiring employees

- Operating as a corporation or partnership

- Filing certain business tax returns

- Opening a business bank account

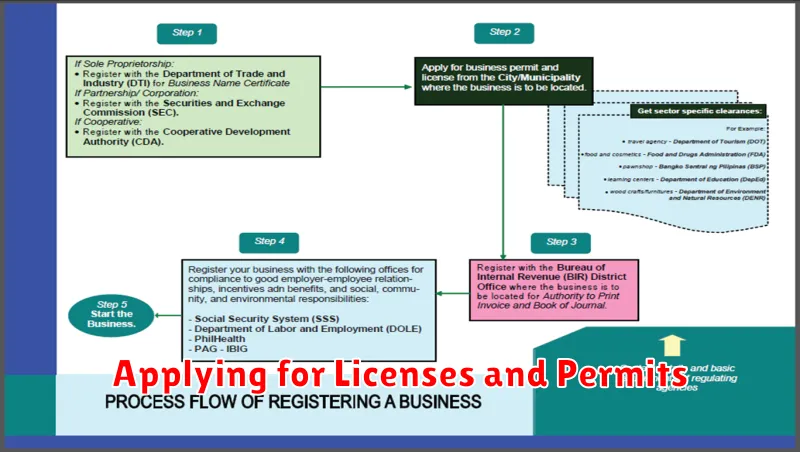

Applying for Licenses and Permits

After registering your business, securing the necessary licenses and permits is crucial for legal operation. This process varies depending on your business structure, industry, and location. Failure to obtain the correct licenses and permits can result in penalties or even business closure.

Begin by researching the specific requirements for your business. Contact your local city or county clerk’s office for information on local licenses and permits. Additionally, check with your state government regarding state-level requirements. Some industries, such as food service or healthcare, may also require federal licenses.

The application process typically involves completing forms, providing documentation, and paying associated fees. Be prepared to provide information such as your business registration details, EIN (if applicable), and proof of insurance.

Opening a Business Bank Account

After registering your business, a crucial next step is opening a dedicated business bank account. This separates your personal and business finances, which is essential for financial organization, liability protection, and tax simplification. It also projects a more professional image to clients and vendors.

Choosing the right bank involves considering factors such as transaction fees, minimum balance requirements, and available online banking features. Research different banks and compare their offerings to find the best fit for your business needs.

When you’re ready to open the account, you’ll generally need to provide documentation such as your business registration documents, Employer Identification Number (EIN), and possibly your personal identification.

Setting Up State Tax Accounts

After registering your business with the federal government, you’ll need to fulfill state-specific requirements. This often involves setting up state tax accounts. Nexus is the key concept here. Nexus is created when your business has a physical presence or significant economic activity within a state. If your business has nexus, you’ll likely need to register with the state’s Department of Revenue or equivalent agency.

The types of state taxes you’ll need to collect and remit vary depending on your business activities and location. Common state taxes include sales tax, income tax, and franchise tax. Refer to your state’s specific guidelines for details.

Registering usually involves completing an application and providing information about your business structure, location, and projected revenue. Once registered, you’ll receive information on filing requirements and payment schedules.

Complying with Local Regulations

After fulfilling state-level requirements, you must ensure your business complies with local regulations. These vary based on your business type, location, and activities. Check with your city or county clerk’s office to understand specific requirements.

Common local regulations include:

- Obtaining a business license.

- Complying with zoning ordinances.

- Adhering to fire and safety codes.

- Paying local taxes, such as property or sales tax.

Failure to comply with local regulations can result in penalties, including fines or even business closure. Therefore, diligent research and adherence are crucial for long-term success.

Keeping Documents Organized

Maintaining organized records throughout the registration process is crucial. This will streamline the process and be invaluable for future reference.

Create a dedicated folder, whether physical or digital, specifically for your business registration documents. Clearly label all documents and organize them logically. Consider using sub-folders for different categories, such as “Tax Documents,” “Legal Documents,” and “Correspondence.”

Examples of documents to keep include your business registration confirmation, tax identification number assignment, articles of incorporation, and any permits or licenses obtained.

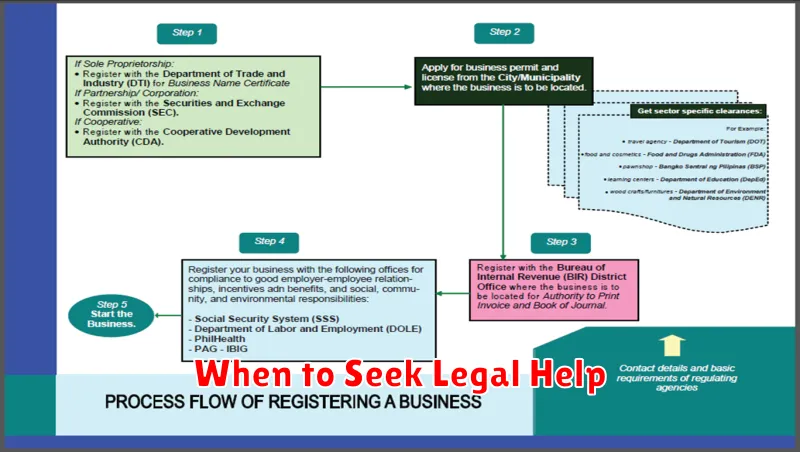

When to Seek Legal Help

While registering a business can often be handled independently, certain situations warrant professional legal counsel. Seeking legal advice proactively can save you time, money, and potential complications down the road.

Consider consulting with a lawyer if your business involves any of the following:

- Complex ownership structures: Partnerships, corporations, or businesses with multiple owners.

- Intellectual property concerns: Trademarks, patents, or copyrights.

- Regulatory compliance: Navigating industry-specific regulations or licensing requirements.

- Contracts and agreements: Drafting or reviewing contracts with suppliers, customers, or employees.

- Raising capital: Seeking investment from venture capitalists or angel investors.

A lawyer can provide expert guidance, ensuring your business is structured correctly and complies with all applicable laws. They can also assist with risk management and help you avoid potential legal pitfalls.